tax exempt blanket certificate ohio

This exemption certificate is used to claim exemption or exception on a single purchase. There are often different certificates for different situations or industries as seen on the New York State Department of Taxation and Finance Exemption Certificates for Sales Tax page.

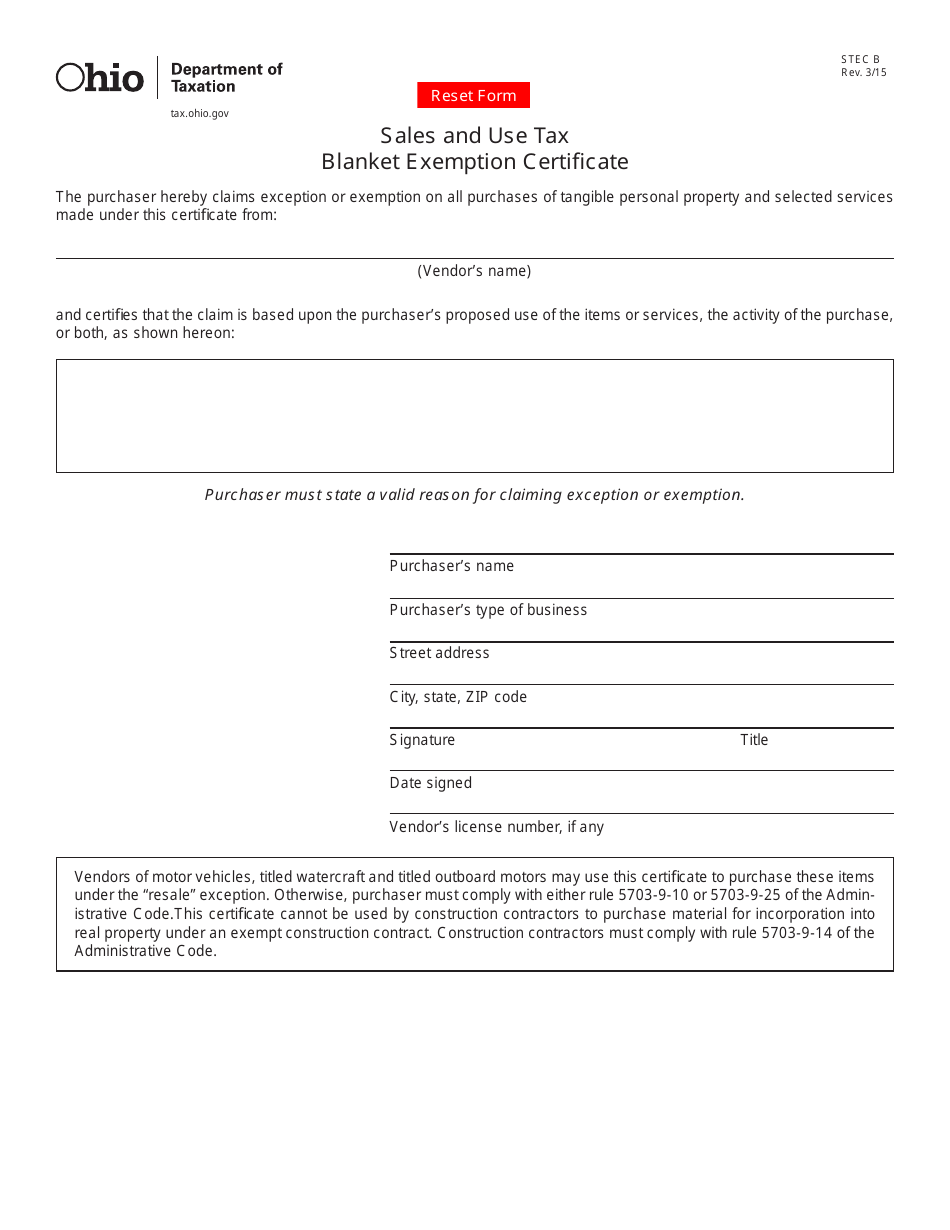

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

To learn more about the sales and use tax administered by the California Department of Tax and Fee Administration please visit the Sales and Use Tax in California homepage.

. Motor Vehicle Exemption. The purchaser is exempt. Since the majority of exceptions or.

Resale certificates are also sometimes called resellers permits or sometimes just the blanket term exemption certificates. Farming is one of the exceptions. Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades.

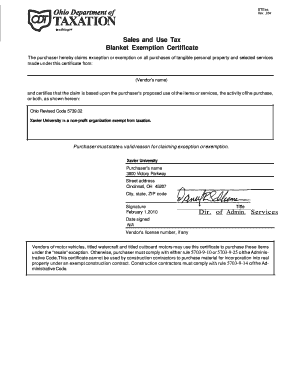

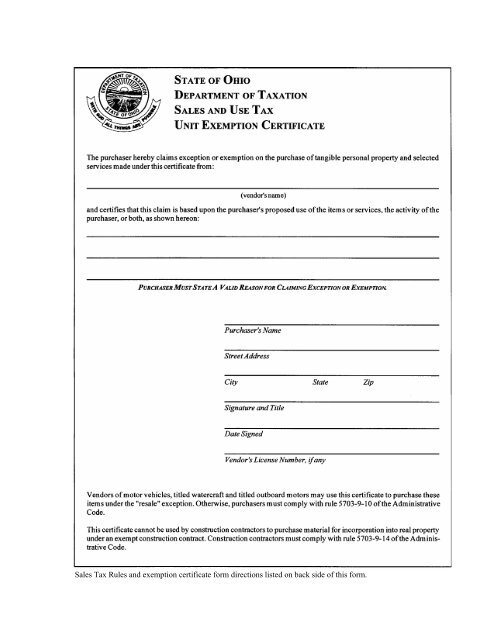

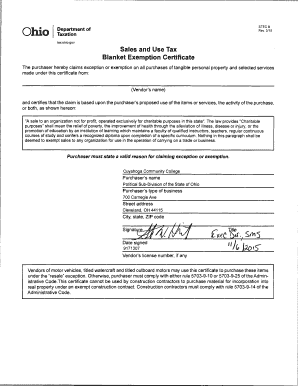

The Unit Exemption Certificate is utilized for the majority of tax exempt purchasing procedures and the Blanket Exemption Certificate is the blanket version of this form. In order for a not-for-profit to be exempt the organization must apply for and be granted exempt sales and use tax status in the states in which they conduct business. Directors List DPI Staff Attorney General Office DMV Staff Speciality Schools information 390 Granville Harry Wilkins 919-693-6412 919-339-2763 919-693-6144.

In instances where similar transactions routinely occur between a buyer and a seller eg a. Exemptions and Exclusions Publication 61. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendorsIn addition to requiring purchaser information such as name address and business type Ohio.

For example if you have a North Carolina resale certificate but try to buy an item tax-free in Maryland your Maryland vendor will be unable to accept your North Carolina-issued resale certificate. You may use an out-of-state sales tax license number to fill out these forms. You can use the Blanket Exemption Certificate to make further purchases from the same seller without having to give a newly completed form every time.

OH Blanket Form Ohio Vendor license. However this does not make all purchases by farmers exempt. I hereby certify under the penalties of perjury that the property purchased by the use of this exemption certificate is to be used for an exempt purpose pursuant to the State Gross Retail Sales Tax Act Indiana Code 6-25 and the item purchased.

Utah TC-721 Form Sales Tax License. If you qualify for tax exemption under a certain category and intend to keep making qualifying purchases this form is for you. State-issued exemption and resale certificates can be found on a state tax authoritys website.

3102015 94636 AM. Streamlined Sales Use Tax Permit. General Exemption Certificate Forms.

Construction contractors must comply with Administrative Code Rule 5703-9-14. Applicable municipal tax unless exempt from sales tax. The product or service is specifically exempt.

Currently Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax. This certificate is used to make a continuing claim of exemption or exception on purchases from the same vendor or seller. In some cases retailers must report use tax rather than sales tax.

IA Sales Tax Exempt Cert or Streamlined Retail Sales Tax Permit. A complete list is available in Sales and Use Tax. The Commission has developed a Uniform Sales and Use Tax Certificate that 38 States accept for use as a blanket resale certificate the use of this certificate is.

Der an exempt construction contract. These forms may be downloaded on this page. There are three reasons why a sale may be exempt from sales or use tax.

NC Schools Superintendent Mark Johnson named Joseph Maimone as the new chief of staff at the state Department of Public Instruction. Sales and Use Tax Unit Exemption Certifi cate. Maimone led a charter school for 20 years and is a member of a.

The product or service is used for an exempt purpose. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. To get a resale certificate in Arizona you may complete the Arizona Resale Certificate Form 5000A the Multistate Tax Commissions Uniform Sales and Use Tax Certificate or the Border States Uniform Sale for Resale Certificate Form 60-0081.

TX Resale Certificate Sales Use Tax Permit.

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Utah Student Loan Forgiveness Programs Student Loan Forgiveness Power Of Attorney Form Utah

Form Stec B Fillable Sales And Use Tax Blanket Exemption Certificate

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form Holland Computers Inc

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms