washington county utah sales tax

In addition the Washington County sales tax is 35. If you are interested in becoming a bidder for an upcoming sale or would like further information on the properties listed for sale you can register at wwwwashington.

Thursday May 19 2022 - Live Auction Limited Sale of Delinquent Properties - Preferred Bid and Undivided Interest Sales Only.

. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. 5 rows The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035. George UT 84770 Phone.

Utah has an 85 sales tax but no income tax. Treasurer stops accepting redemption payments for properties listed for sale. Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you.

2020 rates included for use while preparing your income tax deduction. Our mobile app makes it easy to find the tax rate for your current location. Yearly median tax in Washington County.

Just tap to find the rate Local sales use tax. A county-wide sales tax rate of 16 is. Has impacted many state.

Notice is hereby given that on May 28 2020 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. Utah collects a 685 state sales tax rate on the purchase of all vehicles. The December 2020 total.

The Washington County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Washington County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Washington County Utah. This is the total of state and county sales tax rates. Average Sales Tax With Local.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Utah has state sales tax of 485 and allows. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees.

SALES USE TAX ACT COMBINED SALES AND USE TAX RATES Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of April 1 2016 Please see instructions below Cnty City Hosp Combined Location Code ST LS CO MT MA MF CT HT HH AT SM RH CZ MZ TO TN RR RA Sales Rate Beaver County 01-000 470 1. 2019 Tax Sale. The median property tax in Washington County Utah is 1231 per year for a home worth the median value of 240900.

The latest sales tax rate for Hildale UT. Bell Washington County Clerk of Court is proud to offer RealTaxDeed a web-based service that moves the sale of the Washington County tax deed property online. Notice is hereby given that on May 26 2016 at 1000 AM I will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the following described real estate situated in said county and now held by it under preliminary tax sale.

1 State Sales tax is 485. 2021 Tax Sale. 197 East Tabernacle St.

The entire combined rate is due on all taxable transactions in that tax jurisdiction. 2020 Tax Sale. Taxes of 55 special to the US.

Sales Tax and Use Tax Rate of Zip Code 84791 is located in Saint george City Washington County Utah State. 3 rows Washington County UT Sales Tax Rate The current total local sales tax rate in. Utah is ranked 1131st of the 3143 counties in the United States in order of the.

21 rows The Washington County Sales Tax is 16. See how we can help improve your. 2016 Tax Sale.

Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01. Notice is hereby given that on May 20 2021 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. The Utah state sales tax rate is currently.

And the zero percent tax. Washington County collects on average 051 of a propertys assessed fair market value as property tax. The Washington County sales tax rate is.

This rate includes any state county city and local sales taxes. One of a suite of free online calculators provided by the team at iCalculator. The current total local sales tax rate in Washington UT is 6750.

The 2018 United States Supreme Court decision in South Dakota v. Notice is hereby given that on May 23 2019 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. Some dealerships may also charge a dealer documentation fee of 149 dollars.

The 1 Saint George tax. 051 of home value.

St George Utah George Main Street Historical Items

Washington County Utah Bans Unhosted Short Term Rentals

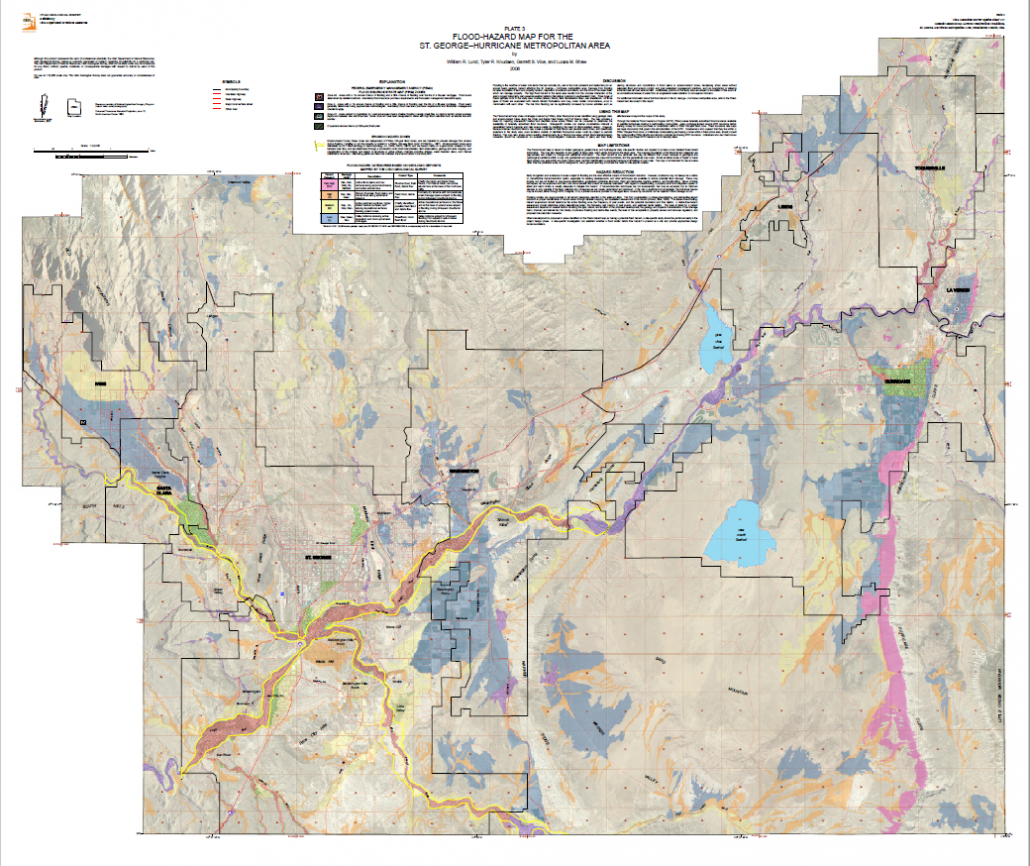

Geologic Hazard Maps For St George Hurricane Area Utah Geological Survey

Secret Way To Dig Up Dirt On Anyone Komando Com Creepy People Case Histories Meeting Someone New

How Healthy Is Washington County Utah Us News Healthiest Communities

The States People Really Want To Move To And Those They Don T Map Geography States

Sales Tax Api Reference Taxjar Developers

The D On The Hill In St George Utah St George St George Utah Black Hills

Washington County Board Of Realtors Adobe Style Homes Adobe Home Home

Utah Sales Tax Small Business Guide Truic

Retirement Nextadvisor With Time Best Places To Retire Places Zion National Park

Beginning Farmer Rancher Workshop Financial Analysis Utah State University Business Planning

Alaska Ranks Top On Us Well Being Survey States In America Wyoming America

Silver Reef Washington County Reef Utah

Geologic Hazard Maps For St George Hurricane Area Utah Geological Survey

Irvine Orthodontics Is A Proud Member Of The American Association Of Orthodontists Your Life Your Smile Let Us Be Your O Orthodontics Orthodontist Dentistry

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation